Made State of the Art Transportation Information System Company More Profitable in 4 Months

|

The Challenge

A prominent Private Equity company wanted to reduce their reputable portfolio company's product cost quickly so it would improve the company's cash flow and profitability. The Goal

The Approach

The Results

|

Corporate turn-around with improved clinical outcomes & utilization at medical healthcare service provider within 9 months

The Challenge

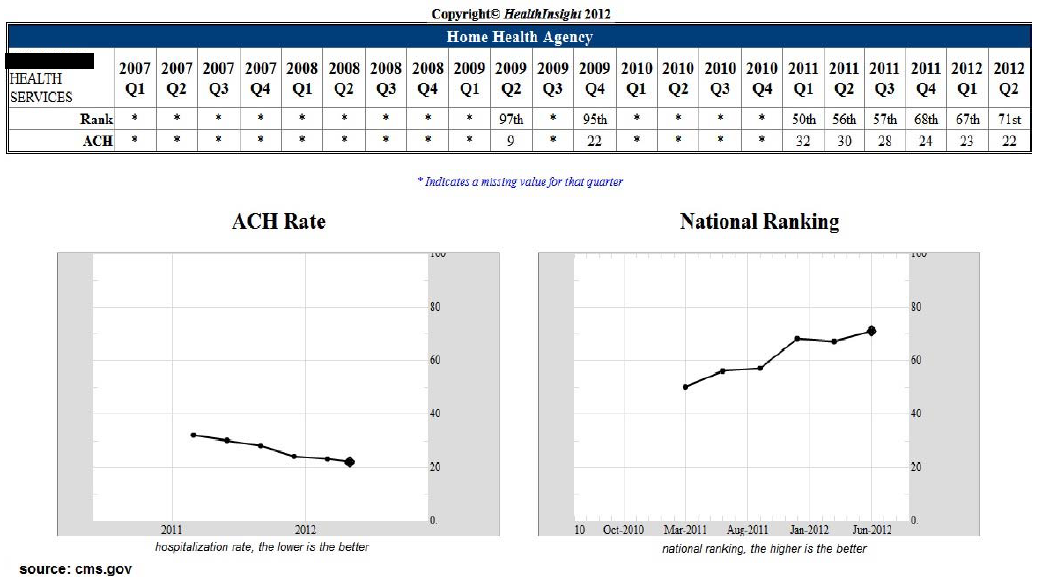

One of our clients failed a Medicare audit, causing CMS (Centers for Medicare & Medicaid Services) to hold back payments, which led to a cash-strapped situation. The client was unable to pay employees and vendors, compromised employee morale, productivity and retention. The executive team was left with substantial patient data without a sound method to use it for clinical or business decisions. They also lost visibility into key financials due to inability to monitor utilization rate and patient outcomes. The result was an unbreakable cycle in which bankruptcy seemed unavoidable. The Goal

The Approach Hired as turn-around CEO, James Stanford (The Stanford Group) implemented the following:

The Results

|

Achieved Supply Chain Optimization by Installing Best Business Practices in A Leading Display Technology Company in 4 Months

The Challenge

Our client’s growth stalled despite their over 80 years of leadership in display technology. Following Private Equity ownership, the company decided to transition its business from a small and entrepreneurial to a mid-size yet scalable company with sustainable growth plans. From the Private Equity’s perspective, their portfolio company needed to breakdown silos, drive collaboration, transform and improve their supply chain and operations organization to support sustainable growth while getting savings from procurement, logistics, field service and operations. The Goal

The Approach We analyzed the current business and built process maps with subject matter experts before simplifying the work-flow which helped streamline the manufacturing and field service operations and cutting cost. Our subject matter experts identified savings potentials across all product lines and categories while building true cost models before negotiating with suppliers. Where needed, we conducted RFQs with supplier conditioning for the best outcome for the client and its suppliers. Installed the best business practices and processes to exceed the promised results. We also identified and resolved production bottlenecks while optimizing the manufacturing footprint. The Results

|

Optimized Tier-1 Audio Product Manufacturing in 5 months

|

The Challenge

Private Equity firm who owned our client wanted us to improve new product introduction and product life cycle management while impacting EBITDA through improving the maturity of the supply chain at the shortest time possible. The Goal

The Approach We analyzed the current business model and product strategies before simplifying the supply chain work-flow and implement the best business practices. We optimized the work by consolidating suppliers and transitioning labor intensive R&D work to tier-1 Electronic Manufacturing Services with control systems in place. We conducted several RFQs with supplier conditioning and negotiations to benefit client and suppliers before signing Master Service Agreement. Finally, we installed Quarterly Business Reviews with suppliers for continuous improvement and sustainable results. The Results

|

Helped Logitech turning a deadly threat from a "mega brand" into a great commercial success

The Challenge

What would Logitech do when a “mega brand company” (prefer not to name it publicly) suddenly threatens Logitech revenues and market share by reducing prices below product cost? The Goal

The Approach

The Results

|

Made Logitech commercialize the 1st in-the-world wireless dongleThe Challenge

Logitech had been challenged in meeting the navigation need of a mobile professionals around the globe. Receiver of "cordless" products actually came with a cord which has been in direct conflict of the wireless concept. The Goal

The Approach We assessed the true market opportunity for wireless solutions. We’ve created the vision of USB wireless dongle and worked with the engineering team to take the challenge of developing this product. We made the commercialization of first wireless product possible with wireless dongle The Results

|

License your IP or Commercialize it?

The Challenge

What does a small start-up with an exciting IP (Intellectual Property) do? Create a niche product with it or license the IP? How and which channels to sell it through if commercialize it? Who to partner with if license it? The Goal Quickly identify the best opportunity based on ROI and ROA among a few business choices The Approach

The Results The company got engaged with industry leaders giving clarity to the company for the best course of action within two months pulling their schedules by six months and saving over $1.5M. |

Services |

Company |

|